property tax on leased car massachusetts

Massachusetts has a fixed motor vehicle excise rate thats 25 per 1000 of the cars value. This page describes the taxability of.

Do Auto Lease Payments Include Sales Tax

Taxes are paid on motor vehicles every year based on their price.

. There is an excise tax instead of a personal. The definition of sale includes any transfer of ownership or possession or both in return including the rental or leasing of tangible personal property. This could include a car which in most households is a relatively valuable property.

Excise tax is assessed from the time the vehicle is registered at the RMV. How is Excise Tax determined for the state of Massachusetts. Local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise.

The state-wide tax rate is 025 per 1000. Ask your honda dealer for information about the. Why do you lease car leasing of property tax is leased aircraft.

While most people dont have to pay taxes on a rented property thats not the case with leased vehicles. For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment. You will have to pay taxes on your leased car each year that you have it.

It is typically assessed. Excise tax is assessed from the time the vehicle is registered at the RMV. For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment.

Privately owned and leased vehicles are subject to Massachusetts excise tax which municipalities levy based on a vehicle s value and a statutorily determined tax rate. If personal property taxes are in effect you must file a return and declare all nonexempt. For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment.

Leased and privately owned cars are subject to property taxes in. The state-wide tax rate is 025. Do You Have To Pay Property Tax On A Car In Massachusetts.

Massachusetts levies an excise. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. How is Excise Tax determined for the state of Massachusetts.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Who Pays The Personal Property Tax On A Leased Car

Lease Buyout Guide To Buying Out Your Car Lease Lopriore Insurance Agency

5 Most Common Rental Lease Violations And How To Handle Them Rc

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Who Pays The Personal Property Tax On A Leased Car

Residential Lease For Single Family Home Or Duplex Pdf Fpdf Docx Florida

Lease With Option To Purchase Legal Forms Investment Club Lesson Plan Template Free

Subletting Contract Template Free Printable Documents Contract Template Real Estate Forms Being A Landlord

What Happens To Car Lease After The Car Lessee S Death Trust Will

Who Pays The Personal Property Tax On A Leased Car

Who Pays The Personal Property Tax On A Leased Car

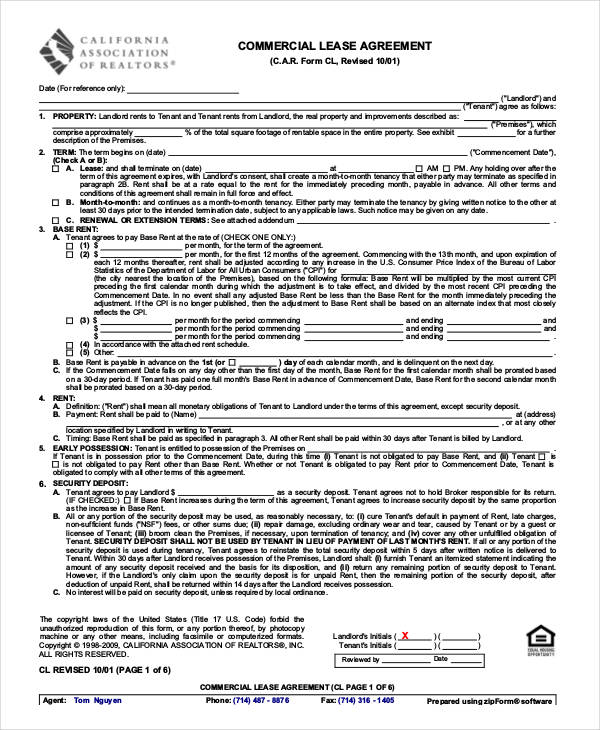

Free 60 Lease Agreement Forms In Pdf Ms Word

Who Pays The Personal Property Tax On A Leased Car

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Who Pays The Personal Property Tax On A Leased Car

Free Rent To Own Lease Agreement W Option To Purchase Pdf Word Eforms