what is the salt deduction repeal

11 rows The TCJA also repealed the Pease limitation for tax years 2018 through 2025. The change may be significant for filers who itemize deductions in high-tax states and.

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Third retroactively repealing the cap on SALT deductions now increases the pressure to repeal them again later.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. It allows those with the most expensive mortgages and by extension the highest incomes to deduct the most reducing their federal taxes by much more than those of the average. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

The House Democrats stepping forward want to see a Biden infrastructure package that repeals the Trump-era limit on state and. A Democratic proposal aims. Finally the TCJA also.

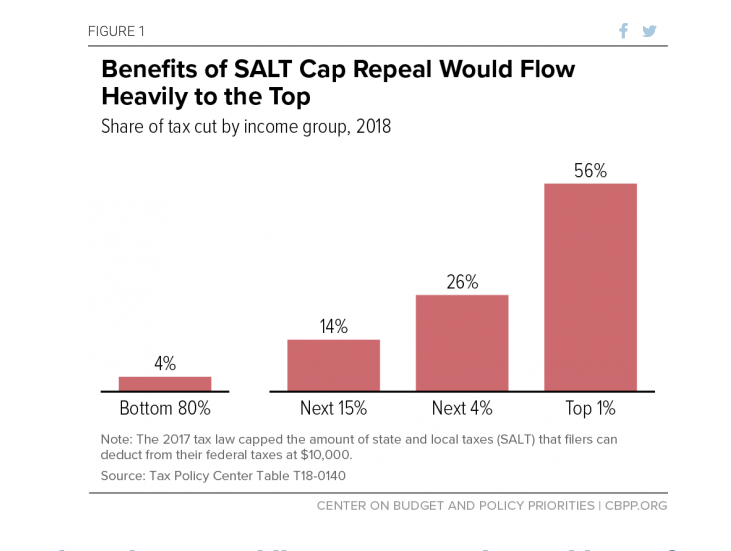

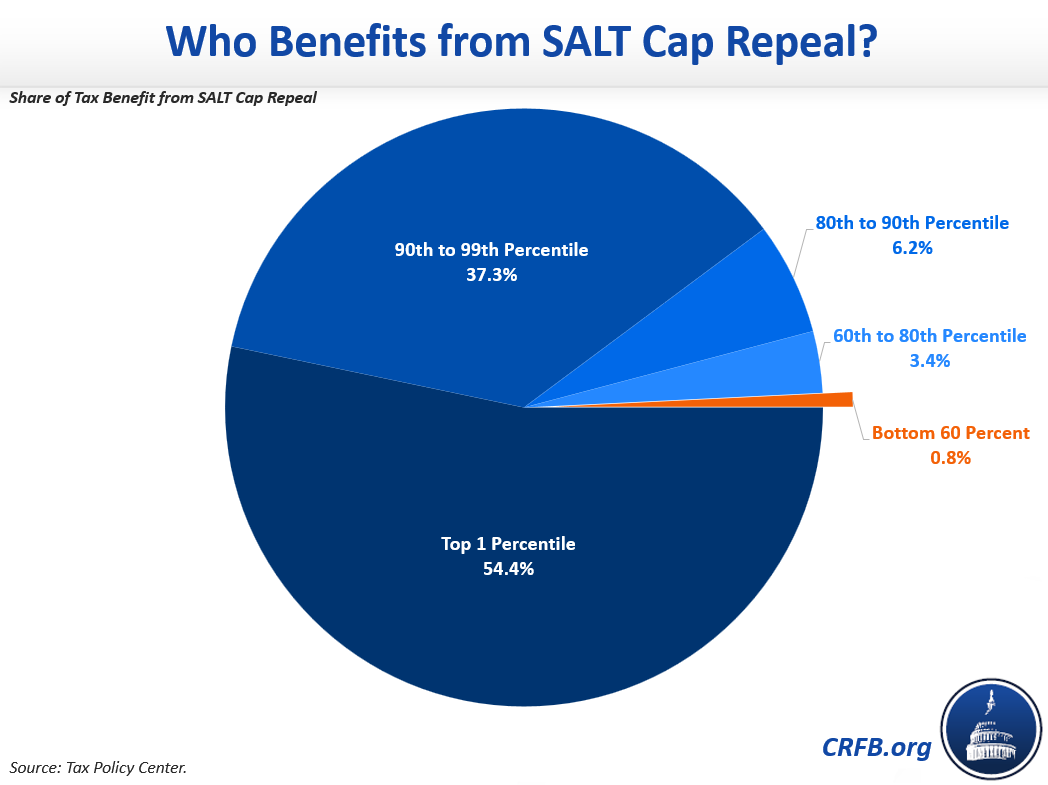

Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. Second the benefits of the base reduction accrue almost entirely to higher-income households. The letter recited most of the usual arguments supporting repeal of the SALT deduction limit so lets take a look at the points it makes and consider whether theyre worth their.

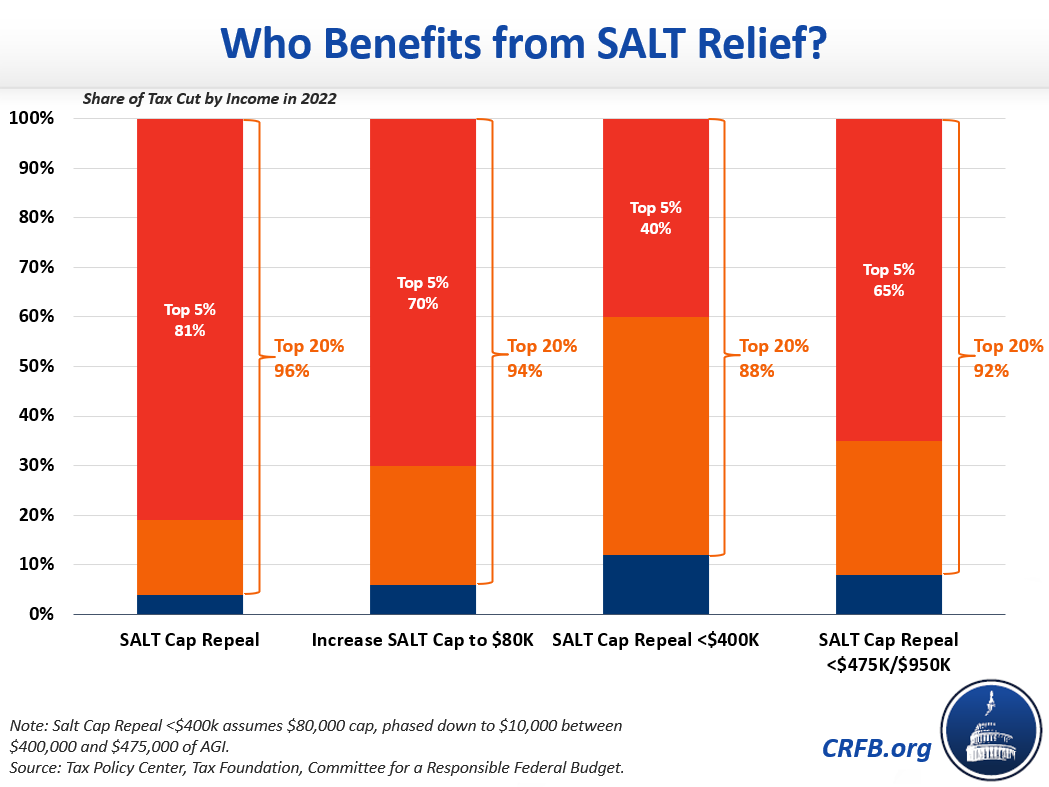

As Democrats debate Build Back Better the plan may still include changes to the 10000 limit on the federal deduction for state and local taxes known as SALT despite reports the. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. Others say thats a tax cut for the rich.

Pelosi defends SALT deduction in Dems spending bill insists it wont benefit the rich Pelosi contradicts nonpartisan analyses showing SALT repeal is boon to the rich. The expansion of the standard deduction. 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state.

Over 50 percent of this reduction would accrue to taxpayers in just four. 54 rows In 2018 only 321 percent of those filers itemized. Preserving the deduction cap or better yet a full repeal of the SALT deduction would result in wealthy residents feeling the full effect of the policies passed by their state and local governments.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. Some Democrats want to repeal the SALT tax deduction cap which they say hurts middle-class taxpayers in high-cost areas. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction.

The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on their taxes. A new bill seeks to repeal the 10000 cap on state and local tax deductions. Democrats are angling to repeal a Trump-era limit on state and local tax deductions as part of President Bidens signature spending plan but a new analysis shows how the bulk of the proposal.

The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize. The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. First the SALT deduction reduces the federal tax base meaning that higher rates are needed to reach any particular revenue target.

Bidens DOJ is trying to preserve the 10000 limiteven though Trump enacted it. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The SALT deduction allows states and localities to give their high income earners a discount on their taxes.

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

State And Local Tax Salt Deduction Salt Deduction Taxedu

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Why Repealing The State And Local Tax Deduction Is So Hard

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Salt Deduction Cap Should Be Reformed Not Repealed Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Deduction Resources Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget